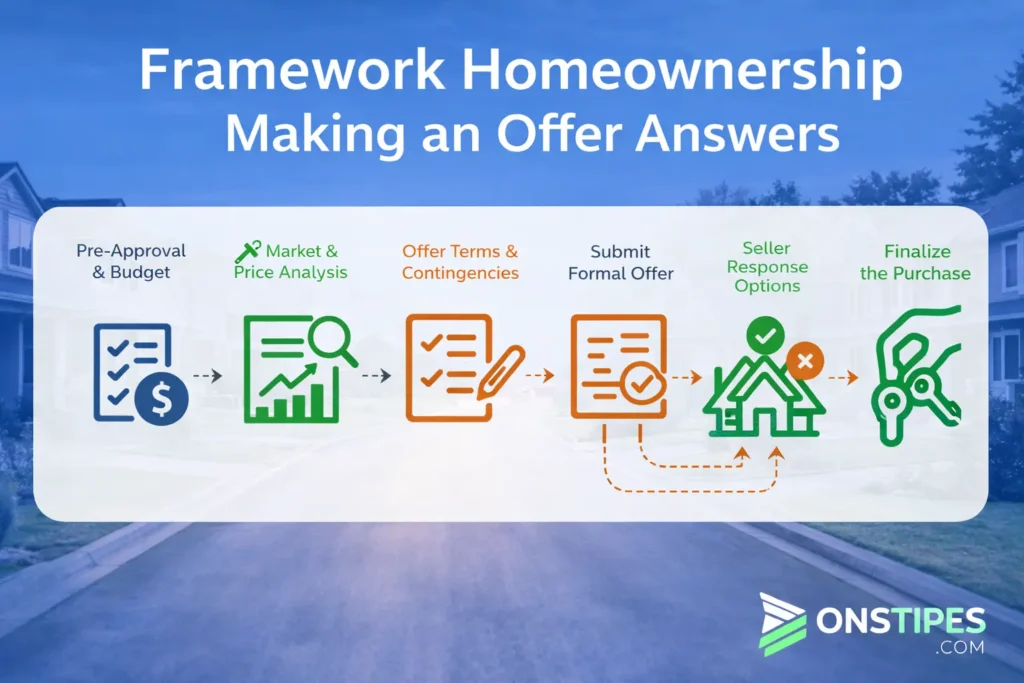

Wage subsidy support worker employment services Gosford NSW

Wage subsidy support worker employment services Gosford NSW

Wage subsidy support worker employment services Gosford NSW are often searched by employers and workforce planners who need clear, practical information before making hiring decisions. These services sit at the intersection of government wage subsidy programs, local employment providers, and the growing demand for support workers across the Central Coast.

The subject goes beyond financial incentives alone. It involves understanding how employment services operate, which roles qualify for wage subsidies, what eligibility rules apply, and how compliance is maintained over time. For support worker roles, these factors matter because care-sector hiring carries specific regulatory and operational responsibilities.

This article explains how wage subsidy support worker employment services function in Gosford NSW in real-world conditions. It focuses on how employers should interpret eligibility, process requirements, and common risks, without promotional language or assumptions about prior knowledge.

What Wage Subsidy Support Worker Employment Services Mean in Gosford NSW

Wage subsidy support worker employment services in Gosford NSW refer to government-supported hiring arrangements where employers receive financial assistance when employing eligible support workers through approved employment services.

These services operate under national workforce programs and are delivered locally through providers on the Central Coast.

- The subsidy reduces wage costs for employers.

- Employment services manage eligibility, compliance, and claims.

- The focus is on sustainable employment, not short-term placement.

How wage subsidies apply to support worker roles

Wage subsidies apply when a support worker role meets defined eligibility and employment conditions set by government programs

Support worker roles typically include disability support, community care, and aged care positions.

- The role must be genuine, ongoing, and paid.

- Minimum weekly hours are usually required.

- The worker must meet program eligibility at the time of hire.

Why employment services are involved

Employment services act as the formal administrators of wage subsidy programs.

Employers cannot usually access subsidies without engaging an approved provider.

- Providers assess eligibility before hiring.

- They lodge subsidy agreements with the government.

- They monitor compliance throughout the subsidy period.

How Gosford NSW fits into the broader system

Gosford operates within the national employment framework while addressing local workforce needs.

Services are delivered under programs such as Workforce Australia, with local providers supporting employers across the Central Coast.

- Local labour shortages influence placement priorities.

- Regional employers may qualify for additional support.

- Providers understand local compliance expectations.

Who Searches for Wage Subsidy Support Worker Services and Why

This topic attracts employers, job seekers, and service providers seeking clarity on eligibility, process, and compliance.

Search intent is primarily informational with a strong decision-making component.

Employers hiring support workers in the Central Coast

Employers search to reduce hiring risk and manage staffing costs.

Support worker roles often involve high turnover and compliance obligations.

- Employers want to confirm subsidy eligibility before hiring.

- They seek clarity on payment timing and conditions.

- They need assurance that roles meet government criteria.

Job seekers entering support work roles

Job seekers search to understand whether wage subsidies affect their employment prospects.

Subsidies can improve access to roles but do not change employment rights.

- Wages must meet award requirements.

- Employment conditions remain standard.

- Subsidies do not reduce worker pay.

Employment service providers facilitating placements

Providers search for policy updates, compliance rules, and market demand.

Their role depends on accurate interpretation of government guidelines.

- Providers must align placements with program rules.

- Local demand shapes placement strategies.

- Compliance failures affect future approvals.

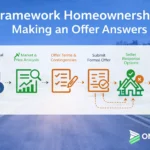

How Wage Subsidy Programs for Support Workers Actually Work

Wage subsidy programs operate through structured agreements between employers, employment services, and the government.

Payments are conditional and performance-based.

The basic wage subsidy structure in Australia

Subsidies provide staged payments to employers who hire eligible workers.

- Payments are capped at a maximum amount.

- Funds are released over defined milestones.

- Employment must be ongoing and paid correctly.

How payments are triggered and assessed

Payments are triggered only after employment conditions are met and verified.

- Employment services confirm continued employment.

- Hours and pay are validated.

- Claims are assessed before release.

Timelines employers should expect

Employers should expect staged payments over several months.

- Initial payment usually follows sustained employment.

- Subsequent payments depend on retention.

- Delays occur if documentation is incomplete.

Employment Services’ Role in Support Worker Wage Subsidies

Employment services are responsible for ensuring subsidy integrity from start to finish.

They act as intermediaries between employers and government systems.

Matching employers with eligible candidates

Providers assess both job seeker eligibility and role suitability.

- Candidate eligibility must exist before hiring.

- Roles must meet program definitions.

- Mismatches can void subsidies.

Managing subsidy applications and approvals

Applications are lodged and tracked by employment services.

- Agreements must be approved before claims.

- Employers cannot self-manage approvals.

- Changes must be reported promptly.

Ongoing compliance and reporting support

Providers monitor compliance throughout the subsidy period.

- Regular employer check-ins occur.

- Employment changes are recorded.

- Non-compliance can suspend payments.

Eligibility Requirements for Wage Subsidy Support Worker Programs

Eligibility depends on employer status, job seeker circumstances, and role structure.

All three must align simultaneously.

Employer eligibility criteria

Employers must be compliant, financially viable, and offering genuine roles.

- Australian business registration is required.

- Award wages must be paid.

- Roles cannot displace existing staff.

Job seeker eligibility conditions

Job seekers must meet program-specific criteria at hiring.

- Eligibility is time-sensitive.

- Status must be verified by the provider.

- Previous employment history may matter.

Role-specific requirements for support workers

Support worker roles must meet care sector standards and subsidy rules.

- Duties must align with the role title.

- Minimum hours apply.

- Casual or short-term roles may not qualify.

Why Wage Subsidies Matter in the Support Worker Job Market

Wage subsidies address staffing shortages while supporting workforce participation.

They are a structural response to labour market pressure.

Workforce shortages and demand in Gosford NSW

Gosford experiences sustained demand for support workers across care sectors.

- Population growth increases service demand.

- Skilled workers are limited.

- Retention remains a challenge.

Cost pressures for employers

Support worker employment involves rising operational costs.

- Training and onboarding are expensive.

- Compliance adds administrative burden.

- Subsidies reduce early-stage risk.

Long-term employment outcomes

Well-managed subsidies improve retention outcomes.

- Employers invest more in supported hires.

- Workers gain stable employment history.

- Turnover reduces over time.

Benefits of Wage Subsidy Support Worker Employment Services

These services create shared benefits across the employment ecosystem.

Benefits for employers

Employers gain financial and operational support.

- Reduced wage risk.

- Administrative assistance.

- Better candidate matching.

Benefits for job seekers

Job seekers gain access to opportunities they might otherwise miss.

- Increased hiring likelihood.

- Stable employment entry points.

- On-the-job experience.

Benefits for local service providers

Providers strengthen workforce outcomes and program performance.

- Improved placement success rates.

- Better employer relationships.

- Stronger regional employment data.

Also Read: Best Ai Avatar Services for Virtual Product Launches

Best Practices for Employers Using Wage Subsidies

Effective use of wage subsidies depends on planning and compliance discipline.

Structuring support worker roles correctly

Roles should be designed to meet both operational and program requirements.

- Define clear duties.

- Set compliant hours.

- Align pay with awards.

Working effectively with employment services

Clear communication with providers prevents delays and errors.

- Share role changes early.

- Respond promptly to requests.

- Confirm eligibility before hiring.

Maintaining compliance throughout the subsidy period

Ongoing compliance is essential for payment continuity.

- Track hours accurately.

- Maintain records.

- Report changes immediately.

Compliance, Reporting, and Government Requirements

Wage subsidy programs are compliance-driven and audit-ready.

Employment contracts and hours tracking

Written contracts and accurate records are mandatory.

- Contracts must reflect actual duties.

- Hours worked must match claims.

- Discrepancies trigger reviews.

Documentation employers must maintain

Employers must retain employment and payroll records.

- Payslips and rosters.

- Contracts and variations.

- Communication records.

What can cause subsidy withdrawal

Subsidies can be withdrawn if conditions are breached.

- Reduced hours without notice.

- Early termination.

- Inaccurate reporting.

Common Mistakes Employers Make with Wage Subsidy Programs

Most issues arise from incorrect assumptions or poor process control.

Assuming all support worker roles qualify

Not every support worker role is eligible for subsidies.

- Casual roles may be excluded.

- Short-term contracts often fail criteria.

- Role design matters.

Poor communication with employment services

Lack of communication leads to compliance failures.

- Changes go unreported.

- Claims are delayed.

- Subsidies are paused.

Misunderstanding payment conditions

Payments are conditional, not guaranteed.

- Milestones must be met.

- Employment must continue.

- Documentation is required.

Tools and Systems Used by Employment Services in Gosford NSW

Employment services rely on digital systems to manage subsidies and placements.

Workforce management and job matching systems

Systems match eligible candidates to suitable roles.

- Skills and availability tracking.

- Employer requirement matching.

- Eligibility verification.

Reporting and compliance tracking tools

Compliance systems track employment status and claims.

- Automated reminders.

- Claim milestone tracking.

- Audit readiness.

Employer communication processes

Structured communication ensures transparency.

- Scheduled check-ins.

- Documentation requests.

- Status updates.

Wage Subsidy Support Worker Hiring Checklist for Employers

A structured approach reduces risk and delays.

Before engaging an employment service

Preparation improves eligibility outcomes.

- Define the role clearly.

- Confirm business compliance.

- Understand subsidy conditions.

During recruitment and onboarding

Correct execution at hiring is critical.

- Verify eligibility before start.

- Issue compliant contracts.

- Record start dates accurately.

During the subsidy claim period

Active management ensures payments continue.

- Monitor hours worked.

- Maintain records.

- Communicate changes promptly.

Wage Subsidies vs Other Hiring Incentives for Support Workers

Wage subsidies are one of several workforce support options.

Training subsidies and grants

Training subsidies offset skill development costs.

- Focus on qualifications.

- Do not reduce wages.

- Often sector-specific.

Apprenticeships and traineeships

These combine employment with formal training.

- Longer commitment.

- Structured learning pathways.

- Different compliance rules.

When wage subsidies are the better option

Wage subsidies suit immediate hiring needs.

- Faster onboarding.

- Reduced initial cost.

- Flexible role structures.

Frequently Asked Questions (FAQs)

1. Who is eligible for wage subsidy support worker employment services in Gosford NSW?

Employers, job seekers, and roles must all meet eligibility rules set under Australian employment programs, with verification handled by approved employment services.

2. Do employers have to use employment services to access wage subsidies?

Yes, wage subsidies are generally administered through approved employment services, which manage eligibility checks, agreements, and compliance reporting.

3. Are wage subsidies limited to disability support worker roles only?

No, wage subsidies are not limited to disability-related roles and may apply to other support worker positions if program conditions are met.

4. How long does it take to receive wage subsidy payments?

Payments are usually made in stages over several months and depend on continued employment, verified hours, and completed reporting milestones.

5. Can small businesses in Gosford NSW apply for wage subsidies?

Yes, small businesses can access wage subsidies provided they are compliant, offer genuine paid roles, and work with an approved employment service provider.