Framework Homeownership Making an Offer Answers

Framework Homeownership Making an Offer Answers

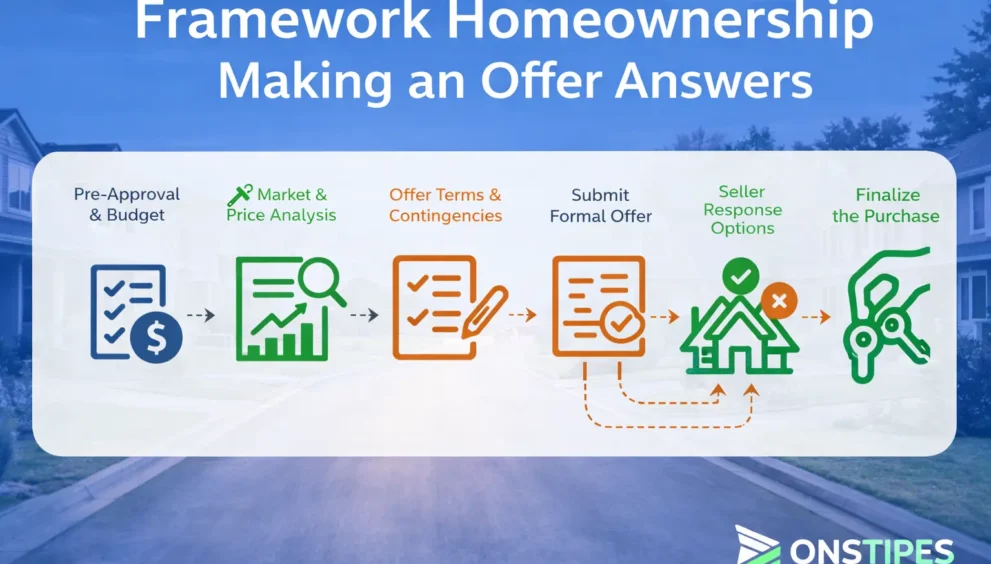

The framework homeownership making an offer answers stage is where a buyer moves from evaluation to commitment. This is the point where decisions start carrying legal, financial, and long-term consequences.

A framework is used at this stage because making an offer is not a single choice. It requires clear answers about price limits, risk exposure, financing readiness, and market conditions.

Instead of relying on instinct, the framework organizes these inputs into a structured decision process. It helps buyers understand what they are agreeing to before an offer is submitted.

The focus is practical clarity. This approach explains how offer decisions are formed, who owns each decision, and where buyers commonly make mistakes during the offer phase.

What the Homeownership Framework Means at the “Making an Offer” Stage

How the framework defines the offer phase

The framework defines the offer phase as the point where buyer intent turns into a legally structured proposal.

It moves the process from browsing to commitment by setting rules around price, terms, and conditions.

In practice, this phase:

- Converts research into a formal offer

- Applies financial and legal checks before submission

- Forces clear decisions instead of assumptions

What decisions are locked in at this stage

At this stage, several decisions become binding once accepted.

These choices shape the rest of the transaction and limit flexibility later.

Key decisions include:

- Maximum purchase price

- Contingencies included or waived

- Closing timeline and conditions

Why this step determines deal success or failure

This step determines success because errors here are hard to undo.

A weak offer can lose the property, while an aggressive one can create long-term risk.

Deal outcomes often hinge on:

- Offer structure, not just price

- Clarity of terms

- Alignment with seller priorities

Also Read: Self Cleaning Street Lamp Research Dust Resistant Lamp Project Exist

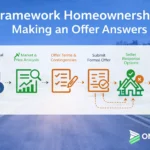

How the Making-an-Offer Process Works Within a Homeownership Framework

Pre-offer preparation checkpoints

Pre-offer preparation ensures the buyer is ready to commit without last-minute issues.

Frameworks require readiness checks before allowing an offer to proceed.

Typical checkpoints include:

- Verified budget and loan pre-approval

- Market price validation

- Risk tolerance confirmation

Translating buyer inputs into an offer decision

Buyer inputs are converted into offer terms using structured rules.

This avoids emotional decisions and keeps offers aligned with capacity.

Inputs usually cover:

- Financial limits

- Must-have protections

- Timing preferences

Submission and response flow

The submission flow follows a defined sequence to reduce delays and confusion.

Once submitted, the framework anticipates seller responses and next steps.

Standard flow:

- Offer submission

- Seller review

- Accept, counter, or reject outcome

Who Is Responsible for Each Decision When Making an Offer

Buyer responsibilities and approvals

The buyer holds final responsibility for all offer decisions.

No framework or advisor replaces buyer approval.

Buyer responsibilities include:

- Approving price and terms

- Accepting risk trade-offs

- Authorizing submission

Agent or advisor role in offer execution

Agents guide execution but do not decide on behalf of the buyer.

Their role is to inform, structure, and communicate.

Typical agent contributions:

- Market insight

- Drafting offer documents

- Negotiation support

Lender and third-party involvement

Lenders and third parties support feasibility, not strategy.

They confirm whether the offer can be funded and closed.

Their involvement includes:

- Loan confirmation

- Appraisal requirements

- Compliance checks

Why the Making-an-Offer Stage Matters More Than Buyers Expect

Financial risk exposure at the offer stage

Financial risk starts before ownership begins.

Poor offer decisions can create immediate and future cost exposure.

Common risks:

- Overpaying beyond market value

- Losing deposits

- Unexpected financing gaps

Legal and contractual implications

An accepted offer becomes a binding contract.

Mistakes here can trigger legal obligations or penalties.

Key implications:

- Enforceable timelines

- Contingency deadlines

- Termination consequences

Long-term affordability consequences

Affordability is set at the offer stage, not after closing.

Stretching too far now affects future financial stability.

Long-term impacts include:

- Monthly cash flow pressure

- Reduced savings capacity

- Higher stress during rate changes

Key Benefits of Using a Framework to Answer Offer-Stage Questions

Benefits for first-time homebuyers

Frameworks reduce uncertainty for buyers with limited experience.

They replace guesswork with structured guidance.

Main benefits:

- Clear decision checkpoints

- Reduced emotional pressure

- Fewer costly mistakes

Benefits for repeat buyers

Experienced buyers benefit from consistency and speed.

Frameworks prevent overconfidence from overriding data.

Advantages include:

- Faster decisions

- Better risk balance

- More predictable outcomes

Benefits for digital homeownership platforms

Platforms use frameworks to standardize buyer behavior.

This improves reliability and compliance across users.

Platform benefits:

- Scalable decision logic

- Lower error rates

- Clear audit trails

Best Practices for Answering “Should I Make This Offer?”

Evaluating price using market data

Price decisions should be anchored in comparable sales.

Frameworks prioritize data over emotion.

Best practices:

- Review recent comparable properties

- Adjust for condition and location

- Set a firm walk-away limit

Balancing competitiveness and protection

Strong offers still need safeguards.

Removing all protections increases exposure without guaranteeing success.

Balanced offers typically include:

- Essential contingencies

- Reasonable timelines

- Clear documentation

Knowing when not to proceed

Walking away is a valid outcome.

Frameworks treat non-action as a decision, not a failure.

Red flags include:

- Budget strain

- Unacceptable risk

- Incomplete information

Financial, Legal, and Market Requirements Before Making an Offer

Financing readiness and documentation

Financing readiness must be confirmed before submission.

Unverified funding weakens offers and delays closing.

Required elements:

- Mortgage pre-approval

- Proof of funds

- Stable income verification

Required disclosures and contingencies

Disclosures and contingencies protect the buyer.

Skipping them increases legal and financial risk.

Common requirements:

- Inspection contingency

- Financing contingency

- Appraisal contingency

Market condition awareness

Market conditions shape offer strategy.

Frameworks adjust guidance based on supply and demand.

Key factors:

- Buyer vs seller market

- Average days on market

- Competing offers

Also Read: Wage subsidy support worker employment services Gosford NSW

Common Mistakes Buyers Make at the Offer Stage

Emotional overbidding

Emotional decisions often override data.

This leads to overpaying or unnecessary risk.

Typical triggers:

- Fear of missing out

- Competition pressure

- Personal attachment

Weak or missing contingencies

Removing protections to appear strong can backfire.

It shifts all risk to the buyer.

Consequences include:

- Costly repairs

- Financing failure

- Legal disputes

Ignoring post-offer obligations

Buyers often focus only on acceptance.

Post-offer deadlines are equally critical.

Missed obligations include:

- Inspection timelines

- Financing milestones

- Contract conditions

Risks Associated With Poorly Structured Offer Decisions

Deal collapse risk

Unclear or weak offers increase failure rates.

Deals often collapse due to preventable issues.

Common causes:

- Financing gaps

- Missed deadlines

- Unresolved contingencies

Unexpected cost exposure

Costs can rise quickly after acceptance.

Poor structure hides these risks upfront.

Examples include:

- Repair costs

- Appraisal gaps

- Rate lock extensions

Contractual and timing risks

Timing errors create legal exposure.

Frameworks exist to prevent missed commitments.

Risk areas:

- Closing delays

- Penalty clauses

- Lost deposits

Tools and Systems Used to Support Offer-Stage Decisions

Comparative market analysis tools

These tools compare recent sales to estimate fair value.

They ground offers in real market behavior.

Used for:

- Price validation

- Negotiation support

- Risk assessment

Mortgage and affordability calculators

Affordability tools test long-term payment comfort.

They prevent buyers from relying on approval limits alone.

Key outputs:

- Monthly payment estimates

- Debt ratios

- Stress-test scenarios

Digital home-buying platforms

Digital platforms integrate data, documents, and workflows.

They enforce consistency across the offer process.

Common features:

- Document management

- Decision checkpoints

- Status tracking

Actionable Checklist Before Submitting an Offer

Financial readiness checklist

Financial readiness must be confirmed in advance.

This avoids last-minute withdrawals.

Checklist items:

- Approved financing

- Cash reserves confirmed

- Budget ceiling set

Property and inspection considerations

Property risks should be assessed early.

Inspection planning matters even before acceptance.

Key checks:

- Property condition review

- Known disclosure issues

- Inspection access

Offer strength and fallback planning

Every offer needs a fallback plan.

Frameworks require defined next steps.

Planning includes:

- Maximum counteroffer limit

- Alternative properties

- Walk-away triggers

Framework-Based Offers vs Traditional Buyer Intuition

Structured decision-making approach

Frameworks rely on rules, data, and checkpoints.

They aim for consistency and risk control.

Core characteristics:

- Repeatable logic

- Documented decisions

- Reduced bias

Intuition-driven buying risks

Intuition alone increases error rates.

It reacts to emotion rather than evidence.

Common risks:

- Overconfidence

- Poor timing

- Inconsistent outcomes

When a hybrid approach works

A hybrid approach combines data with experience.

It allows judgment without ignoring structure.

Best use cases:

- Competitive markets

- Experienced buyers

- Clear risk boundaries

What Happens After an Offer Is Submitted

Acceptance scenarios

Acceptance confirms agreement on all terms.

The transaction moves into execution.

Next steps include:

- Contract finalization

- Inspection scheduling

- Financing progression

Counteroffers and renegotiation

Counteroffers reopen specific terms.

Frameworks help evaluate changes quickly.

Buyers should:

- Reassess affordability

- Reconfirm risk tolerance

- Respond within deadlines

Rejection and next steps

Rejection ends that specific attempt.

Frameworks treat rejection as feedback.

Typical responses:

- Adjust strategy

- Re-enter the market

- Pause if conditions change

Frequently Asked Questions (FAQs)

1: What does framework homeownership making an offer answers actually mean?

Framework homeownership making an offer answers refers to a structured way of deciding whether and how to submit a home purchase offer. It organizes price limits, risk tolerance, financing readiness, and legal conditions into clear, answerable decisions before an offer is made.

2: How does a framework help buyers avoid bad offer decisions?

A framework helps by forcing buyers to confirm affordability, market data, and protections before acting. This reduces emotional bidding, missed contingencies, and rushed commitments that often lead to regret or deal failure.

3: Is using a framework only useful for first-time homebuyers?

No, frameworks are equally useful for repeat buyers. Even experienced buyers benefit from structured checks that prevent overconfidence, ensure consistency, and account for changing market conditions.

4: Can a framework improve negotiation outcomes with sellers?

Yes, a framework improves negotiation by setting clear boundaries in advance. Buyers know when to counter, when to accept changes, and when to walk away without second-guessing under pressure.

5: When should a buyer decide not to make an offer at all?

A buyer should avoid making an offer when the price exceeds long-term affordability, key contingencies cannot be included, or critical information is missing. A framework treats walking away as a valid and responsible decision.