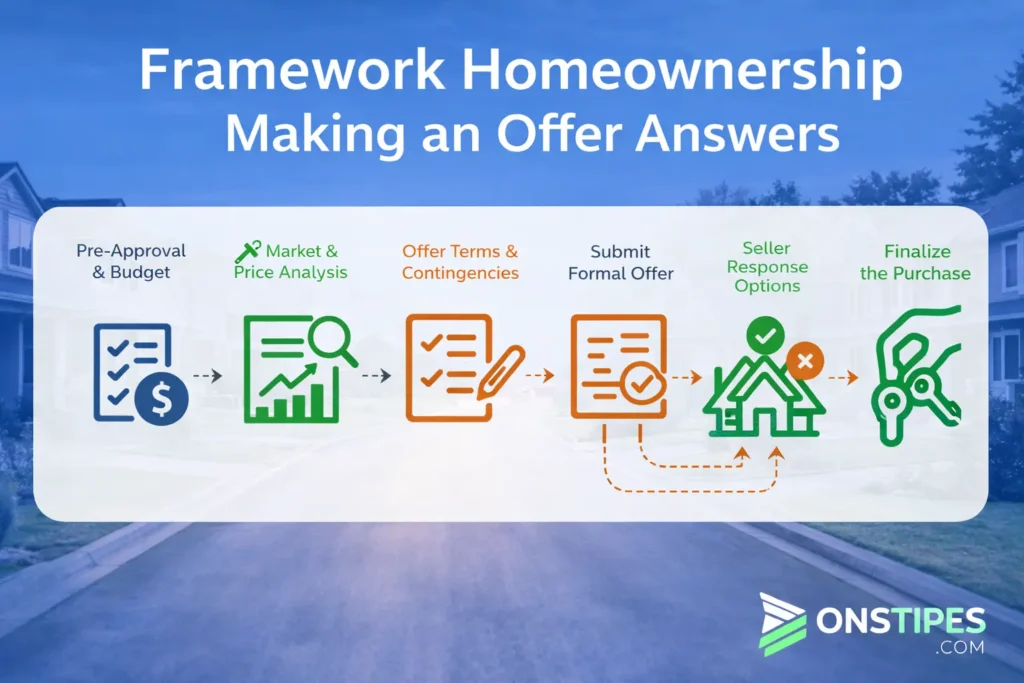

Global Skills Gosford Wage Subsidy Support Worker

Global Skills Gosford Wage Subsidy Support Worker

Global skills Gosford wage subsidy support worker programs exist to reduce the cost and risk of hiring in roles that are often hard to fill. For employers in the Gosford and Central Coast area, these subsidies provide structured financial support when taking on eligible support workers through approved employment services.

The focus is practical, not promotional. Employers want to know how the subsidy works, who qualifies, and what obligations come with it before committing to a hire. This topic sits at the intersection of workforce policy, compliance, and day-to-day operations.

Understanding how global skills Gosford wage subsidy support worker arrangements function helps employers make informed hiring decisions, avoid compliance issues, and assess whether a subsidised support worker role fits their business needs.

What Is the Global Skills Wage Subsidy Program in Gosford?

How Global Skills employment services operate in the Gosford region

Global Skills operates as a government-funded employment services provider supporting employers and job seekers in Gosford.

It connects businesses with eligible candidates and manages wage subsidy arrangements on behalf of employers.

- Works under national employment programs and guidelines

- Screens candidates for eligibility before referral

- Manages subsidy agreements, compliance checks, and reporting

- Acts as the main liaison between employers and government systems

What a wage subsidy means for local employers

A wage subsidy is a financial contribution paid to employers to offset part of a new employee’s wages.

The payment reduces upfront hiring risk without changing standard employment obligations.

- Paid after employment milestones are met

- Does not replace wages or reduce award requirements

- Linked to ongoing, genuine roles

- Designed to encourage sustainable hiring, not temporary labour

How support worker roles fit into subsidy programs

Support worker roles are commonly eligible because they address workforce gaps and entry-level employment needs.

These roles often involve on-the-job skill development, making them suitable for subsidised placements.

- Frequently used in care, services, and community sectors

- Structured roles with supervision and training

- Aligned with long-term employment outcomes

Who Is This Wage Subsidy Designed For?

Employers eligible to access wage subsidies

Eligible employers are businesses offering genuine, paid roles that meet employment standards.

Most small and medium employers in Gosford qualify if they meet basic compliance rules.

- Active ABN and lawful business operations

- Ability to provide stable hours and supervision

- No recent breaches of workplace laws

Job seekers and support workers covered under the program

Eligible workers are registered job seekers assessed by Global Skills as meeting subsidy criteria.

Eligibility depends on employment history and program requirements, not employer preference.

- Often long-term unemployed or early-career workers

- May require structured onboarding and support

- Eligibility is confirmed before placement

Business types commonly using wage subsidies in Gosford

Local service-based businesses are the most frequent users of wage subsidies.

These employers benefit from reduced hiring risk and supported onboarding.

- Disability and aged care providers

- Hospitality and accommodation businesses

- Cleaning, facilities, and community services

- Small retail and service operations

How the Global Skills Gosford Wage Subsidy Works

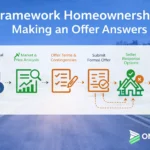

Step-by-step overview of the wage subsidy process

The wage subsidy follows a defined approval and employment process.

Employers cannot apply after hiring has already occurred.

- Employer registers interest with Global Skills

- Candidate eligibility is confirmed

- Employment agreement is approved

- Work commences under standard conditions

- Payments are released after milestones

How payments are structured and released

Payments are staged and linked to employment duration.

They are paid directly to the employer after verification.

- Initial payment after early employment period

- Subsequent payments at agreed intervals

- Evidence of ongoing employment required

Typical duration and funding limits

Most wage subsidies run for several months with capped funding.

Exact amounts depend on program rules and worker eligibility.

- Common durations range from 6 to 12 months

- Funding is capped rather than open-ended

- Payments stop if employment ends early

What Is a Support Worker Role in This Context?

Common industries hiring subsidised support workers

Support workers are mainly hired in people-focused and service-driven sectors.

These industries benefit from gradual skill development.

- Disability and aged care

- Community and social services

- Education and childcare support

- Hospitality and facilities services

Skills and responsibilities expected from support workers

Support workers are expected to assist core operations under supervision.

The role balances practical tasks with learning and development.

- Client or service support duties

- Following workplace procedures

- Communication and teamwork

- Gradual increase in responsibility

Difference between support worker and general roles

Support worker roles are structured for development, not immediate full productivity.

This distinction supports subsidy eligibility.

- Defined learning and supervision elements

- Clear progression expectations

- Stronger alignment with workforce programs

Employer Responsibilities When Using a Wage Subsidy

Employment conditions and fair work obligations

Employers must meet all standard employment laws regardless of subsidies.

The subsidy does not alter award or minimum wage requirements.

- Pay correct wages and superannuation

- Provide lawful working conditions

- Follow Fair Work standards

Training, supervision, and role stability requirements

Employers must actively support the worker’s success in the role.

Subsidies rely on meaningful employment, not nominal placement.

- Onboarding and task training

- Ongoing supervision

- Reasonable expectation of continued work

Reporting and progress checks during the subsidy period

Employers must confirm employment status at agreed checkpoints.

Reporting ensures public funding is used correctly.

- Employment confirmation forms

- Attendance and continuity checks

- Notification of changes or issues

Why Wage Subsidies Matter for Gosford Employers

Addressing workforce shortages in the Central Coast

Wage subsidies help fill roles that struggle to attract candidates.

They lower barriers for hiring and training new workers.

- Expands the available talent pool

- Supports workforce participation

- Reduces vacancy duration

Reducing hiring risk for small and medium businesses

Subsidies offset early employment costs during onboarding.

This is particularly valuable for smaller employers.

- Shared financial risk

- Time to assess role fit

- Support during initial training

Supporting long-term employment outcomes

The program focuses on sustained employment, not short placements.

This benefits both employers and workers.

- Better retention outcomes

- Stronger skill development

- Reduced turnover costs

Key Benefits of the Global Skills Wage Subsidy

Financial benefits for employers

Employers receive structured financial support tied to employment milestones.

- Reduced wage cost during early months

- Predictable payment structure

- No impact on employee entitlements

Career benefits for support workers

Workers gain paid employment and practical experience.

- Real workplace exposure

- Skill development and references

- Improved long-term employability

Broader economic impact on the local community

The program supports local employment stability.

- Increased workforce participation

- Reduced reliance on income support

- Stronger local service capacity

Eligibility Criteria Employers Must Meet

Business registration and compliance requirements

Employers must be legally registered and compliant.

- Active ABN

- No unresolved compliance breaches

- Capacity to meet payroll obligations

Role eligibility and minimum employment conditions

Roles must be genuine, paid, and ongoing.

- Minimum hours per week

- Award-aligned duties

- Clear job description

Worker eligibility considerations

Worker eligibility is assessed independently by Global Skills.

- Employment history review

- Program-specific criteria

- Confirmation before placement

Also Read: north minnesota owned trucking business’s owner name randy

How to Apply Through Global Skills Gosford

Initial employer registration process

Employers begin by registering interest with Global Skills.

- Business details provided

- Role requirements outlined

- Eligibility reviewed

Matching candidates with subsidised roles

Candidate matching occurs after eligibility confirmation.

- Pre-screened candidates referred

- Employer interviews conducted

- Final approval issued before start

Approval timelines and documentation

Approvals are completed before employment commences.

- Employment agreement signed

- Subsidy terms documented

- Start date confirmed

Compliance and Ongoing Requirements to Keep the Subsidy

Monitoring employment continuity

Employment must continue as agreed for payments to proceed.

- Regular attendance required

- Role must remain unchanged

- Any issues must be reported

What can cause subsidy withdrawal

Subsidies may stop if conditions are breached.

- Early termination without valid reason

- Reduced hours below agreement

- Non-compliance with reporting

Audit and review considerations

Programs are subject to review and audit.

- Employment records may be requested

- Payment claims verified

- False claims may require repayment

Common Mistakes Employers Make with Wage Subsidies

Misunderstanding eligibility rules

Assuming all hires qualify is a common error.

- Eligibility must be confirmed first

- Retrospective applications are not allowed

Treating subsidies as short-term labour solutions

Subsidies are not designed for temporary staffing.

- Roles must be genuine

- Long-term intent is required

Incomplete documentation and reporting

Missing paperwork delays or cancels payments.

- Late forms

- Incorrect employment details

- Failure to notify changes

Comparing Global Skills Wage Subsidies With Other Hiring Incentives

Global Skills vs Workforce Australia wage subsidies

Both operate under government frameworks but differ in delivery.

- Global Skills provides localised employer support

- Workforce Australia may involve different providers

- Eligibility rules are similar but processes vary

Wage subsidies vs training grants

Wage subsidies support employment, not training costs alone.

- Subsidies offset wages

- Training grants fund qualifications

- Some employers use both

When subsidies are not the right option

Subsidies are unsuitable for short-term or casual roles.

- Seasonal work

- Contract-only positions

- Roles without supervision capacity

Employer Checklist Before Hiring a Subsidised Support Worker

Readiness assessment for businesses

Employers should confirm internal readiness first.

- Stable workload

- Capacity to train

- Payroll compliance

Role suitability checklist

The role must meet program conditions.

- Ongoing employment intent

- Minimum hours met

- Clear responsibilities

Compliance and documentation checklist

Proper records are essential from day one.

- Signed employment contract

- Subsidy agreement in place

- Reporting calendar noted

Frequently Asked Questions (FAQs)

1: What is the global skills gosford wage subsidy support worker program?

The global skills gosford wage subsidy support worker program is a government-supported hiring arrangement where eligible employers receive financial assistance when employing approved support workers through Global Skills in the Gosford region.

2: Who is eligible to receive a wage subsidy through Global Skills Gosford?

Eligibility is limited to employers offering genuine, ongoing roles and to job seekers who meet program criteria assessed by Global Skills before employment begins.

3: Does a wage subsidy reduce my legal responsibilities as an employer?

No. Employers must still meet all Fair Work obligations, including correct pay rates, superannuation, safe working conditions, and proper employment records.

4: Are wage subsidies paid upfront or after the employee starts?

Wage subsidies are paid in stages after employment milestones are met, not upfront, and only after employment has been verified.

5: What happens if a subsidised support worker leaves early?

If employment ends early, future subsidy payments stop, and previously paid amounts may be reviewed depending on the reason and timing of the exit.