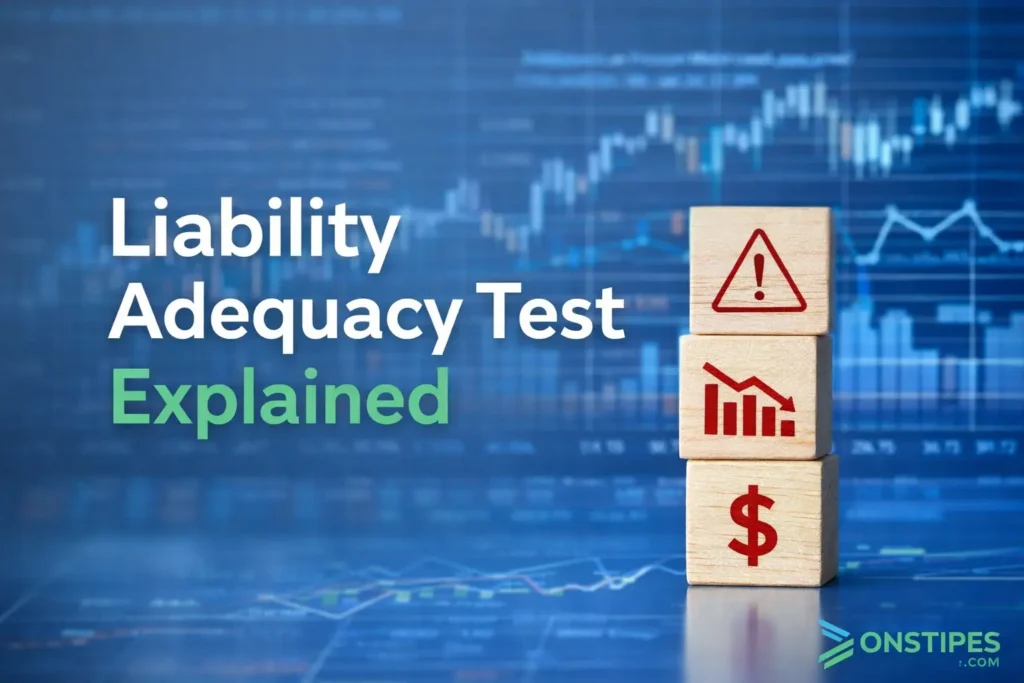

Liability Adequacy Test

Insurance liabilities sit at the center of financial reporting credibility. When insurers recognize obligations on their balance sheets, the underlying assumption is that those amounts are sufficient to meet future claims, benefits, and related costs. The liability adequacy test exists to challenge that assumption. It acts as a safeguard, requiring insurers to step back and assess whether previously recorded liabilities still reflect economic reality as assumptions, data, and risk profiles evolve.

This topic matters because insurance obligations are long dated and uncertainty heavy. Small changes in claims trends, expense levels, or discount rates can materially affect whether liabilities remain adequate. Without a structured test, shortfalls can remain hidden until they surface as financial stress, regulatory intervention, or sudden earnings volatility. The liability adequacy test was designed to force earlier recognition of those gaps, improving transparency for regulators, auditors, investors, and policyholders.

Today, the concept is often discussed alongside changes in insurance accounting frameworks and evolving measurement models. While its formal role has shifted under newer standards, understanding how the liability adequacy test works and why it was introduced remains essential for evaluating insurance financial statements, legacy reporting periods, and transitional disclosures.

What Is a Liability Adequacy Test and Why It Exists

A liability adequacy test is a financial reporting assessment used by insurers to confirm that the insurance liabilities already recorded on the balance sheet are sufficient to cover expected future cash outflows. In practical terms, it asks a simple but critical question: based on current information, would the insurer incur a loss if these obligations were settled today? If the answer is yes, the recorded liability must be increased immediately.

The test exists because insurance liabilities are inherently uncertain and often span many years. Estimates made at contract inception can become outdated as claims experience, expenses, or economic assumptions change. Without a formal adequacy check, those changes might only be reflected gradually or not at all, allowing understated liabilities to persist in financial statements.

Historically, the liability adequacy test was required under frameworks such as IFRS 4, where liability measurement methods varied widely across jurisdictions. The test acted as a minimum safety net, ensuring that even when different valuation approaches were used, insurers still recognized losses as soon as liabilities became insufficient.

Which Types of Insurance Liabilities Are Assessed

The liability adequacy test applies to insurance liabilities that represent future service obligations, not every balance sheet item. Its focus is on liabilities where cash outflows depend on uncertain future events, such as claims occurrence, severity, and timing. These are the areas where outdated assumptions are most likely to create hidden shortfalls if not actively reassessed.

In practice, this commonly includes unearned premium liabilities, outstanding claims provisions, and other policy related reserves. Unearned premiums are particularly sensitive because they assume that future premiums will be sufficient to cover remaining risk periods. If expected claims and expenses exceed those unearned amounts, the liability is no longer adequate and must be adjusted.

For long duration or complex contracts, such as life or health insurance, the scope can extend to policy benefit liabilities that rely on long term actuarial assumptions. Changes in mortality, morbidity, lapse rates, or expenses can materially affect adequacy. The test ensures these assumptions remain aligned with current expectations, not historical averages.

A common misunderstanding is assuming the test applies to all technical provisions uniformly. In reality, it targets liabilities where measurement methods may lag economic reality. Assets, solvency capital, and regulatory buffers are outside its scope, which is why adequacy testing should never be confused with broader capital or stress testing exercises.

Also Read: Edvera Licensing and Accreditation Management Software User Guide

When Insurers Are Required to Perform a Liability Adequacy Test

Insurers are required to perform a liability adequacy test at each reporting date when accounting standards mandate an explicit check on whether recognized insurance liabilities remain sufficient. Under earlier insurance accounting frameworks, this requirement was ongoing and applied regardless of whether there were visible warning signs. The intent was preventive rather than reactive, ensuring deficiencies were identified before they became material problems.

In practice, the test is triggered by the preparation of financial statements, not by adverse events alone. Even if claims experience appears stable, changes in assumptions such as discount rates, expense inflation, or policyholder behavior can still lead to inadequacy. This makes the test a routine part of year end and interim reporting processes rather than an exceptional review.

The requirement also becomes especially important during transitional periods, such as changes in accounting policies or adoption of new standards. During these phases, legacy liabilities measured under older approaches must still be assessed for adequacy using current information. This helps prevent mismatches between historical measurement methods and present economic conditions.

A frequent mistake is assuming the test is only necessary when losses are expected. In reality, standards require it precisely because emerging shortfalls are not always obvious. Waiting for visible deterioration defeats the purpose of adequacy testing and undermines the reliability of reported insurance liabilities.

How the Liability Adequacy Test Works in Practice

In practice, a liability adequacy test compares the carrying amount of recognized insurance liabilities with a current estimate of future cash outflows arising from those obligations. The assessment is forward looking and uses up to date information rather than assumptions locked in at contract inception. If expected future cash flows exceed the recorded liability, the difference represents an immediate shortfall.

The process typically starts with projecting all relevant future cash flows, including claims payments, benefits, and directly attributable expenses. These projections reflect current experience, recent trends, and revised expectations rather than historical averages alone. Where the timing of cash flows is material, discounting is applied to reflect the time value of money using assumptions consistent with the reporting framework.

Once projected cash flows are calculated, they are compared to the existing liability balance on the balance sheet. If the liability is sufficient, no adjustment is required. If it is not, the insurer must recognize the deficiency immediately in profit or loss, increasing the liability. A common misconception is that this adjustment can be deferred or smoothed over time. Adequacy testing is explicitly designed to prevent that.

Key Assumptions and Inputs That Affect Test Outcomes

The outcome of a liability adequacy test depends heavily on the assumptions used to estimate future cash flows. Even when the methodology is sound, small changes in assumptions can materially alter whether a liability appears adequate. For this reason, standards require insurers to use current, realistic inputs rather than conservative or outdated estimates.

Key assumptions typically include expected claims frequency and severity, future expense levels, policyholder behavior, and where relevant, discount rates. Claims assumptions must reflect recent experience and observable trends, not long term averages that no longer apply. Expense assumptions should capture inflation, operational changes, and claims handling costs directly attributable to insurance obligations.

Discount rates play a particularly sensitive role when cash flows extend over multiple periods. Using rates that are inconsistent with economic conditions can either mask or exaggerate deficiencies. Guidance emphasizes consistency between discounting assumptions and the characteristics of the underlying liabilities.

A common mistake is treating assumptions as purely actuarial inputs detached from business reality. In practice, underwriting changes, pricing actions, and claims management practices all influence expected outcomes. Adequacy testing works best when actuarial models are informed by operational insight, not built in isolation.

Also Read: Best Ai Avatar Services for Virtual Product Launches

How Deficiencies Are Identified and Recognized in Financial Statements

A deficiency is identified when the current estimate of future cash outflows exceeds the carrying amount of the related insurance liabilities on the balance sheet. The liability adequacy test does not allow judgment about materiality over time. Once a shortfall is identified, it is treated as economically real and must be addressed immediately. This is a deliberate design choice to prevent delayed loss recognition.

When a deficiency exists, the insurer increases the relevant insurance liability and records the offsetting amount as an expense in profit or loss for the period. The adjustment is not allocated across future periods and cannot be deferred to align with expected premium income. This immediate recognition reinforces transparency and ensures that reported results reflect current economic conditions.

Under frameworks such as IFRS 4, this recognition mechanism acted as a safeguard against optimistic reserving practices. It ensured that even when different liability measurement methods were permitted, losses were recognized as soon as obligations became onerous.

A frequent misunderstanding is assuming that deficiencies can be absorbed through future pricing changes or portfolio growth. Financial reporting does not allow this offset. Adequacy testing is liability specific and forward looking, focusing solely on whether existing obligations are already under reserved at the reporting date.

Common Mistakes and Misinterpretations in Liability Adequacy Testing

One of the most common mistakes is confusing liability adequacy testing with prudential solvency assessments. The test is an accounting exercise focused on financial statement accuracy, not a measure of capital strength or regulatory resilience. Treating it as a capital buffer analysis leads to incorrect assumptions about scope, methodology, and outcomes.

Another frequent error is relying on locked in or outdated assumptions. Because the test is explicitly based on current estimates, using historical loss ratios or expense assumptions without adjustment undermines its purpose. This often happens when adequacy testing is treated as a mechanical compliance task rather than an analytical review of emerging experience.

Some insurers also misunderstand the level at which the test should be applied. Performing high level portfolio assessments without considering segments with materially different risk profiles can mask deficiencies. Adequacy issues often emerge in specific products or cohorts, not evenly across the book.

Finally, there is a misconception that passing the test once reduces the need for future scrutiny. In reality, adequacy testing is recurring by design. Passing results do not validate assumptions indefinitely. They only confirm sufficiency at a specific reporting date under current conditions.

How the Liability Adequacy Test Fits Within Insurance Accounting Standards

The liability adequacy test sits within insurance accounting standards as a protective mechanism, not a primary measurement model. Its role has been to ensure that whatever valuation approach an insurer uses, the resulting liabilities are not understated when assessed against current expectations. This made the test especially important in frameworks that allowed diverse accounting practices.

Under earlier standards such as IFRS 4, insurers were permitted to continue using many local or legacy measurement methods. Because of this flexibility, comparability across insurers was limited. The liability adequacy test acted as a minimum threshold, forcing recognition of losses when existing methods produced insufficient liabilities.

With the introduction of IFRS 17, the formal role of the liability adequacy test has changed. IFRS 17 embeds adequacy considerations directly into its measurement framework through current assumptions, explicit risk adjustments, and the identification of onerous contracts. As a result, a separate standalone test is no longer required in the same form.

Despite this shift, understanding how the liability adequacy test fits into the broader evolution of insurance accounting remains important. It explains why older disclosures look the way they do, how transition adjustments were assessed, and how modern standards aim to achieve the same objective through more integrated measurement models.

Differences Between Liability Adequacy Testing and Solvency or Stress Testing

Liability adequacy testing is often mistakenly grouped with solvency or stress testing, but the objectives and methods are fundamentally different. The liability adequacy test focuses on whether recognized insurance liabilities are sufficient at the reporting date, based on current estimates. It is an accounting assessment tied directly to financial statements, not a forward looking resilience analysis.

Solvency testing, by contrast, evaluates whether an insurer holds enough capital to withstand adverse scenarios. It incorporates extreme but plausible shocks, regulatory capital requirements, and broader balance sheet interactions. Passing a solvency test does not imply liabilities are adequately measured for accounting purposes, just as passing an adequacy test does not imply strong capital adequacy.

Stress testing goes even further by modeling hypothetical scenarios that may never occur, such as severe economic downturns or catastrophic claims events. These exercises inform risk management and regulatory planning, not liability measurement. They are deliberately conservative and scenario driven, while adequacy testing relies on best estimate assumptions.

A common mistake is assuming positive solvency results can compensate for an accounting shortfall. Financial reporting does not allow this substitution. Liability adequacy testing addresses the accuracy of existing obligations, whereas solvency and stress tests address an insurer’s ability to survive future uncertainty.

How the Relevance of Liability Adequacy Testing Has Evolved Over Time

The relevance of liability adequacy testing has changed as insurance accounting standards have evolved, but its underlying objective has remained consistent. Originally, the test played a central role because liability measurement approaches varied widely across jurisdictions and products. It served as a backstop, ensuring that minimum adequacy was maintained even when accounting methods were inconsistent.

As standards developed, particularly with the move toward current measurement frameworks, adequacy considerations became more embedded in day to day liability valuation. Rather than relying on a separate end stage test, newer models require assumptions to be updated continuously and losses to be recognized earlier in the measurement process itself. This reduced the need for a standalone adequacy check.

Despite this shift, liability adequacy testing remains relevant in practice. Legacy portfolios, comparative financial analysis, education, and transitional reporting all still reference the concept. Analysts and auditors continue to use it as a mental framework for assessing whether reported insurance liabilities make economic sense.

Understanding this evolution helps readers interpret both historical and modern financial statements. It clarifies why older disclosures emphasize adequacy tests and why newer standards pursue the same goal through more integrated and transparent measurement approaches rather than a separate compliance exercise.